Context

Examining the preceding decade, e-commerce has emerged as a pivotal catalyst for digital economic expansion in Indonesia. Its rapid growth has been substantial not just locally but globally, particularly during the Covid-19 pandemic, which constrained physical engagements. Data from Meta forecasts a 17% growth in overall e-commerce in Southeast Asia and Indonesia from 2022 to 2027, with anticipated total Gross Merchandise Volume (GMV) figures of US$280 billion and US$121 billion respectively. However, this growth rate is a deceleration compared to the surge experienced from 2021 to 2022, which reached a 48% increase in Southeast Asia and a 32% rise in Indonesia.

Although e-commerce significantly contributes to Indonesia’s Gross Domestic Product (GDP), its impact remains relatively modest when compared to the broader GDP. Research from the Indonesia Digital Literacy Survey reveals that only 33.4% of active internet users in Indonesia engage in e-commerce, with a mere 34.1% of businesses participating in such activities. This points to the limited adoption of e-commerce in Indonesia, with conventional businesses predominantly controlling the market.

Despite the immense potential of Indonesia’s digital economy, this hasn’t translated directly into widespread e-commerce penetration. Traditional offline shopping practices continue to hold sway, especially in tier 2 and 3 cities in Java, owing to restricted access to online platforms. In reality, for every three individuals, only one shops through e-commerce. Moreover, those engaging in e-commerce still predominantly shop offline, while the remaining two solely resort to offline purchases. These conclusions stem from the 2022 Indonesia Digital Literacy Survey encompassing 10,000 respondents across 34 provinces in Indonesia.

Consumer satisfaction and trust play pivotal roles in deterring non-users from online shopping, primarily due to concerns regarding product quality not meeting advertised standards. Other deterrents for non-users include apprehensions about product quality, fraud risks, and logistical challenges. These facts present both opportunities and challenges for online platforms to effectively address these concerns.

According to research findings from Katadata, Small and Medium-sized Enterprises (SMEs) conducting exclusive online sales are likely to plateau within an annual turnover range of US$ 6.4 million. Therefore, it’s imperative to encourage successful SMEs in the digital domain to venture into the offline realm, unlocking the potential for much higher turnovers. Thus, Online sales channels suit brands focusing on turnover increments within the range of US$ 1.3 – 6.4 million, offering a more efficient and effective means of establishing a robust market presence. On the other hand, brands with turnovers above US$ 6.4 million per year have reached a stagnant growth level in the online channel, requiring an alternative focus on other sales channels, specifically offline sales channels.

In contrast to brands hitting the US$ 6.4 million turnover threshold, those with annual sales exceeding US$ 32 million exhibit a clearer trend favouring offline channels compared to the online channel . National brands catering to a diverse Indonesian customer base, especially in areas with limited or no online access, thrive through their entrenched offline business networks. Their business tentacles in the offline channels are deeply rooted and can accommodate national demands throughout the country. Offline sales channels tend to have a much higher growth ceiling compared to online channels due to the larger consumer base in offline channels, especially in lower-tier cities. Referring to statistical data from Indonesia, 88% of the population resides in tier 2 and tier 3 cities, and only 34% of the total population actively uses e-commerce.

Connected Commerce

Several businesses/startups in the field of facilitating trade for SMEs are attempting to create a consumer network based on communities and networks of various SMEs as providers of goods needed within the community. Larger capital companies also collaborate and allow some of their facilities to be used by other companies to facilitate consumers in shopping, transactions, and picking up goods. Both examples above represent an approach and collaboration that is currently termed “connected commerce.”

Connected commerce provides SMEs with an alternative to expand exposure, enhance awareness, access markets, and distribute goods. Each sales channel caters to different demographic profiles, thus necessitating marketing strategies through various sales channels to accommodate these differences and adapt to shifts in offline sales trends. Connected commerce enables a brand to accommodate diverse consumers within each demographic profile.

To elucidate the concept of connected commerce, consider a global example such as IKEA, which successfully implements the omnichannel approach. IKEA seamlessly integrates various sales channels, providing a shopping experience that seamlessly merges online and offline realms. Consumers can shop at the outlet, track online purchases’ delivery, view catalogues, make online purchases, and pick up items at the outlet, all seamlessly and without hindrance. This integrated shopping experience defines connected commerce, offering consumers the flexibility to shop according to their preferences through a unified online and offline experience.

From a brand’s perspective, adopting connected commerce entails utilising technology that oversees and tracks orders across the entire system. The position of connected commerce lies at the intersection between social commerce, e-commerce, and traditional retail stores. More precisely, connected commerce plays a role in connecting and integrating various types of sales channels.

Connected Commerce as an Omnichannel Form

In academic research, connected commerce is considered the latest iteration of the omnichannel concept, as it directly connects and integrates all systems directly related to consumers. Omnichannel, according to Ieva and Ranfagni, involves integrating and adapting a brand’s resources to meet emerging challenges, such as maintaining substantial consistency in brand values, attributes, and overall image across various services, experiences, and channels provided, while developing a seamless experience for their customers.

In everyday life, urban residents frequently encounter implementations of connected commerce. For instance, If someone shops through an app and easily decides to pick up their purchase from a store without requiring extensive confirmations for the purchase and payment, that individual has experienced the convenience of connected commerce. . The implementations vary, but they all contribute to enriching the consumer’s buying experience and fostering trust in product purchases. Figure 1, as illustrated, depicts potential variations of connected commerce to aid readers in understanding its various forms.

Figure 1: Illustrated Concept of Connected Commerce

The omnichannel concept within connected commerce provides opportunities for every consumer interaction to form an integrated journey, thereby enhancing the consumer-brand relationship. The omnichannel concept enhances consumer trust in product purchases by enriching the consumer’s buying experience. According to research by BCG and Facebook, 94% of Indonesian consumers prefer sellers who engage in communication and discussions, instilling a sense of security and creating a delightful consumer experience.

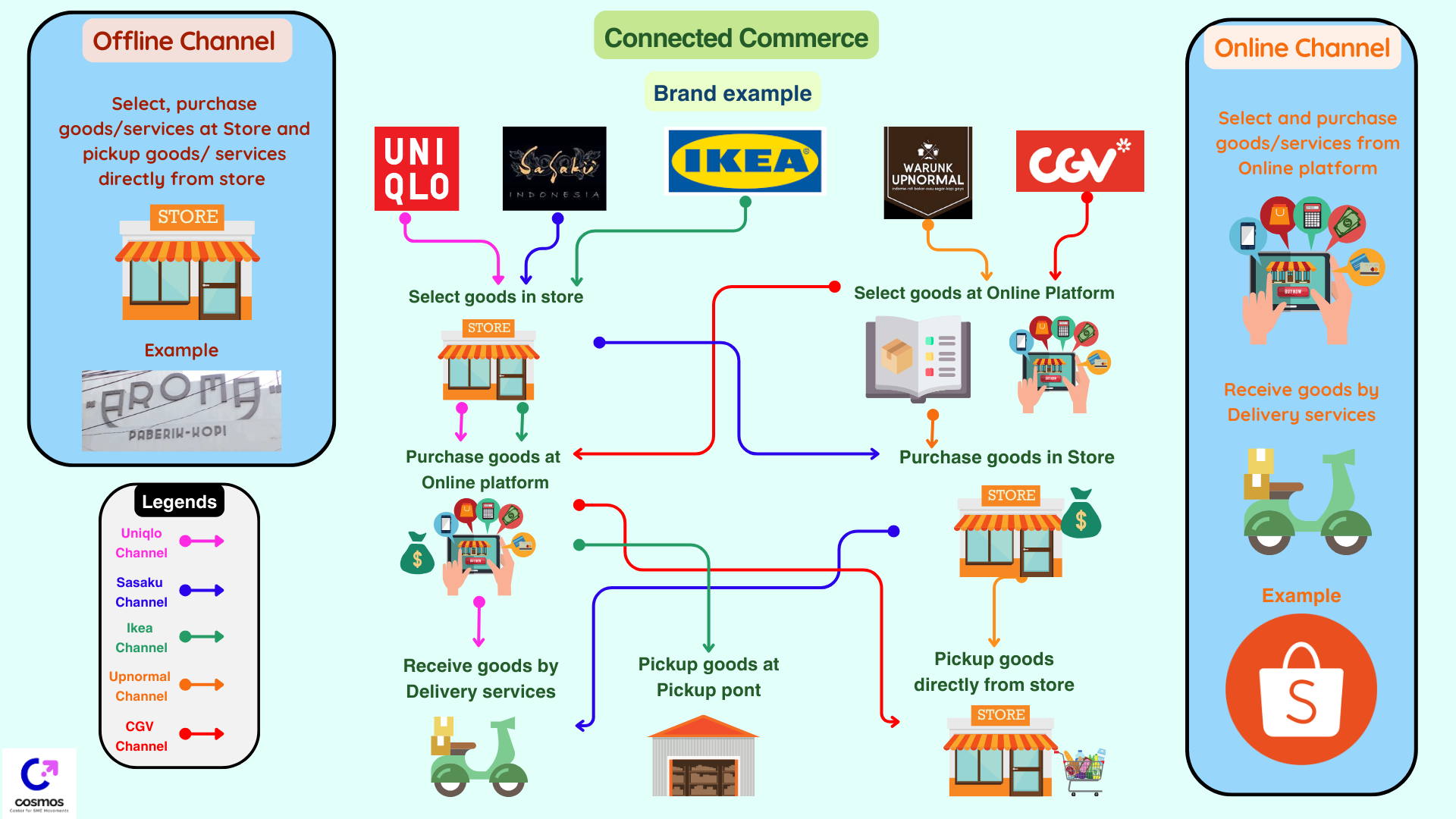

Figure 2: Flow of Connected Commerce System

Figure 2 shows the flow of a connected commerce system which appears quite complicated yet interlinked. All examples of brands implementing the connected commerce concept enable consumers to choose products from brick-and-mortar stores or online platforms. Essentially, the transaction process begins with consumers selecting items, making payments, and receiving the purchased goods. None of these sequences are constrained by specific sales channels that consumers must follow. Consumers can purchase items and make payments online while still having the option to collect the goods from an offline sales channel. Conversely, consumers can also make purchases and payments at an offline sales channel while choosing to receive the items at available pick-up points or at the desired address online. This flow can seamlessly alternate back and forth because the system is already integrated and supported by high-end technology.

Success Stories of Brands Implementing Connected Commerce

Interviews conducted by Katadata with various national brands emphasise the unique demographic profiles and growth ceilings of each sales channel. These brands recognize the necessity of tailored promotional strategies for each channel to sustain sales without breaching the perceived growth ceiling. The online channel remains a crucial element for brands with turnover below US$ 6.4 million. However, the online channel tends to have a relatively short and easily attainable growth ceiling. Conversely, the offline channel exhibits a notably higher growth ceiling compared to the online counterpart.

These brands acknowledge the significance of a connected commerce strategy as their brand expands and channels become more complex. Connected commerce assists brands in leveraging opportunities from evolving consumer behaviours by allowing consumers to interact seamlessly across integrated online and offline channels. Success stories of national brands that shifted their marketing strategies towards connected commerce include Zaskia Mecca, Wardah, Kutus Kutus, Kintakun, Avoskin, and 3second. Intense market competition necessitates cutting-edge innovation to maintain and surpass growth ceilings in sales. Managing the circulation of sales channels within connected commerce is quite complex, especially considering the need to sustain competitiveness in an increasingly crowded market. By collaborating with Evermos, these brands endeavour to simultaneously cater to the needs of consumers in tier 2 and 3 cities, particularly those not engaged in e-commerce.

Challenges

The challenges associated with connected commerce may seem applicable mostly to large-scale businesses, but innovation is crucial for all players in the business landscape, including Small and Medium-sized Enterprises (SMEs), to compete in the open market. On the other hand, SMEs attempting offline expansion sometimes encounter obstacles due to the significant costs involved in building offline awareness, such as listing fees, billboard/TV/radio advertising costs, inventory consignment fees, and more. SMEs and all players in Indonesia’s economic supply chain cannot independently resolve this integration issue. Therefore, government support is essential to build the necessary infrastructure and ecosystems to enable SMEs to compete in an open market by leveraging their respective strengths. The government can act as a mediator between SMEs and larger investors, as well as all players within the supply chain, to create a level playing field. This would foster an environment where SMEs can compete effectively and fairly in the market.

Government Support

The government plays a vital role in fostering a level playing field by building necessary infrastructure and ecosystems for SMEs. Supportive regulations are essential to drive Indonesia’s transition from a technology consumer to a technology producer. The government’s progressive steps, outlined in various regulations and programs, are commendable. Facilitating collaborative efforts among SMEs, suppliers, manufacturers, and logistics will foster fair competition in the market. Pro-SME policies and programs have been outlined in several regulations such as Law No. 20 of 2008 concerning SMEs, Minister of Economic Affairs Regulation No. 8/2019 regarding the Implementation Guidelines for KUR (People’s Business Credit), and SME digitalization programs.

Furthermore, the government can take on the role of a collaborative initiator that unites SMEs with suppliers, manufacturers, and logistics to realize an ideal omnichannel approach, provide a fair playing field, and ensure equal access to quality goods for all communities throughout the country.

Conclusion

Acknowledging Indonesia’s geographical conditions and limited internet access, traditional offline sales channels continue to dominate the retail landscape. Brands exploring alternative channels can capitalise on new opportunities in the broader market, achieving sustainable growth while navigating the dynamics of the Indonesian market. To become a national brand, reaching consumers, particularly in lower-tier cities, is imperative. While online channels hold significance, market leaders are often deeply rooted in offline channels. However, the costs associated with establishing offline channels are considerably higher compared to those of an online-only presence. To access these consumers, brands need to prioritize the use of offline channels through physical retail outlets and distribution networks, enabling connection with these segments.

Reference :

https://www.silicon.co.uk/e-marketing/ecommerce/connected-commerce-next-generation-omnichannel-464392

Salvietti, G., Ziliani, C., Teller, C., Ieva, M., & Ranfagni, S. (2022). Omnichannel retailing and post-pandemic recovery: building a research agenda. International Journal of Retail and Distribution Management, 50(8–9), 1156–1181. https://doi.org/10.1108/IJRDM-10-2021-0485